montgomery county al sales tax

100 South Lawrence Street 3075 Mobile Hwy. The most populous location in Montgomery County Alabama is Montgomery.

County Commission Montgomery County Al

SalesSellers UseConsumers Use Tax Form.

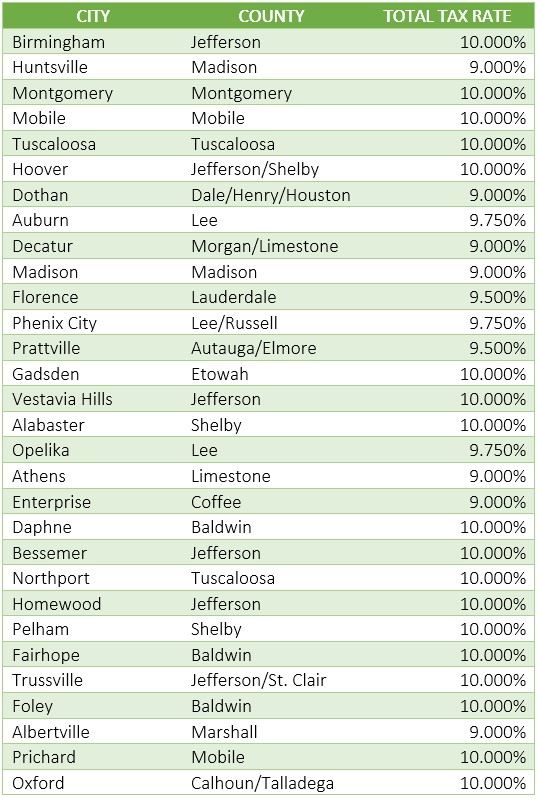

. The 10 sales tax rate in Montgomery consists of 4 Alabama state sales tax 25 Montgomery County sales tax and 35 Montgomery tax. The average cumulative sales tax rate in Montgomery Alabama is 10. If you do not have one please contact Montgomery County at 334 832-1697 or via e-mail.

For questions or assistance phone 334 832-1697. 3 rows Montgomery County AL Sales Tax Rate The current total local sales tax rate in Montgomery. 40-10-29 the purchaser of the Montgomery County Alabama tax lien certificate can apply for a tax deed to the property by surrendering the Montgomery County Alabama tax lien certificate to the Judge of Probate who in turn issues a tax deed Sec.

In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return your local taxpayer ID number assigned to you by these jurisdictions. The Montgomery County sales tax rate is. The minimum combined 2022 sales tax rate for Montgomery Alabama is.

To report a criminal tax violation please call 251 344-4737. This is the total of state county and city sales tax rates. Sales Tax Audit.

Within Montgomery there are around 27 zip codes with the most populous zip code being 36117. Did South Dakota v. Has impacted many state nexus laws and sales tax collection requirements.

Box 5070 Montgomery AL 36101. What is the sales tax rate in Montgomery Alabama. Tags and Registration.

The Montgomery sales tax rate is. The Alabama sales tax rate is currently. Some cities and local governments in Montgomery County collect.

The Montgomery County Sales Tax is 25. If you need information for tax rates or returns prior to 712003 please contact our office. Montgomery is located within Montgomery County Alabama.

4 rows Montgomery. There is no applicable special tax. Montgomery AL 36104-1667 334 832-1250.

County SalesUse Tax co Sarah G. There is no applicable special tax. Or 5340-B Atlanta Hwy.

Search Jobs Agendas Minutes Employee Login. Rental Tax Return- City. Motor FuelGasolineOther Fuel Tax Form.

The 2018 United States Supreme Court decision in South Dakota v. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. The current total local sales tax rate in Montgomery AL.

The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Ad New State Sales Tax Registration. 6 rows The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state.

The County sales tax rate is. As far as all cities towns and locations go the place with the highest sales tax rate is Montgomery and the place with the lowest sales tax rate is Grady. Montgomery County AL Home Menu.

The average cumulative sales tax rate between all of them is 932. Walk-in filing may be done at the following locations. Box 4779 Montgomery AL 36103-4779.

Spear Montgomery County Revenue Commissioner PO. The sales tax rate does not vary based on zip code. Instructions for Uploading a File.

This includes the rates on the state county city and special levels. Sales Taxes Alabama information registration support. AL Sales Tax Rate.

Please click on the link below to show examples of property tax calculations by different municipal codes within Montgomery County. Taxpayer Bill of Rights. Montgomery AL 36104 Phone.

Police Jurisdiction Lodging Tax. If the property is not redeemed within the 3 three year redemption period Sec. 334-625-2994 Hours 730 am.

Police Jurisdiction Sales Tax. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. The rate type is noted as Restaurant in MAT.

City of Montgomery Sales Tax. To report non-filers please email. A county-wide sales tax rate of 25 is applicable to localities in Montgomery County in addition to the 4 Alabama sales tax.

Real Property Tax Calculations. However However pursuant to Section 40-23-7 Code of Alabama 1975 you may request quarterly filing status if you have a tax liability of less than 240000 for the preceding calendar year. Free viewers are required for some of the attached documents.

The Food Service Establishment Tax is a five percent 5 sales tax levied in lieu of the five 5 general sales tax on the gross proceeds of sales at retail of food andor beverages sold for consumption. The most populous zip code in Montgomery County Alabama is 36117. The Alabama state sales tax rate is currently.

Sales Tax Audit Montgomery County Al

Martin S Restaurant Here S How Montgomery S Tax Collection Works

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fast Facts About Montgomery County Montgomery County Al

2015 Nobility Riviera I Mobile Home For Sale In Clearwater Fl Mobile Homes For Sale Retirement Community Mobile Home

Emergency Rental Assistance Montgomery County Eramco Montgomery County Al

Montgomery Real Estate Agent Fired After Ad About Election Of Black Mayor Realestatephotography Realestatede National Doctors Day News Health World Water Day

Maintenance Districts Montgomery County Al

Montgomery Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Appraisal Montgomery County Al

A County Office Montgomery County Al

Chicago Now Home To The Nation S Highest Sales Tax Sales Tax Tax Chicago

Lead Academy Asks County Commission For Portion Of Sales Tax Funds

1861 English Legal Document Original Paper Ephemera Hand Etsy Paper Ephemera Paper Old Paper